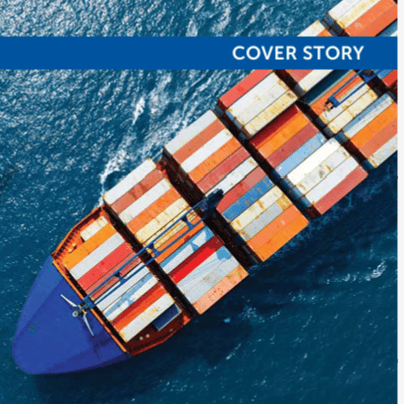

The implications of Trump’s tariffs on the food industry and the consequences for cold chain operators worldwide.

Before the 2024 United States election, President Donald Trump called tariffs “the most beautiful word in the dictionary.” Since taking office, he has implemented some of the most dramatic and consequential changes in global trade policy seen in a generation.

Few areas of trade policy are as controversial, emotive, or consequential as agriculture and food. Even at the height of the “free trade era,” the world made only modest progress in opening agricultural markets. As the United States seeks to accelerate an ongoing reset in global trade relations and countries around the world reassess the value of bilateral and multilateral trade alliances, food tariffs, regulations, and border controls will be a top focus for governments worldwide.

The following four examples illustrate how consideration of food and agriculture issues can dominate how countries set trade policies and approach deals.

Riding the Wave – China and the United States

Cold chain businesses serving U.S. agricultural exporters are at the mercy of the rolling trade tensions of the world’s two largest economies. China is a lucrative market for U.S. food exports, especially soybeans and key proteins, as the country has struggled to satisfy its growing middle class’ demand for protein over the past three decades. This directly benefits U.S. meat exporters and soybean farmers who supply this key animal feed ingredient to China’s fast-growing and intensifying red meat and poultry producers.

Unsurprisingly, tariff wars make U.S. exporters nervous. In April, Caleb Ragland of the American Soybean Association told World Grain magazine: “As the No. 1 export crop for the United States, soybean producers face huge, disproportionate impacts from trade flow disruptions, particularly to China, our largest market. Soybean farmers still have not fully recovered market volumes from the damaging impacts of the 2018 trade war, and this will further exacerbate economic hardship on our farmers.”

Ragland has a right to be concerned. In 2017, China accounted for 30% of the entire U.S. soybean crop, and due to retaliatory tariffs, soybean exports declined by 76% in 2018.

Pork and dairy exports also declined by a more modest but still significant 12%. However, it was the period after the tariff wars that was most striking. The so-called “Phase 1” negotiations resulted in conditions that allowed for U.S. agricultural exports to rebound to record highs. The general relaxation of tensions provided the backdrop for China’s decision to allow U.S. beef imports into China for the first time. By 2024, beef exports to China were valued at over $2 billion.

Tariffs dominate the headlines, but more subtle actions can be just as, if not more, disruptive to trade. In the early weeks of the recent dispute, China suspended the export licenses of three major U.S. soybean exporting companies and, in February, allowed more than 85 meat processing and storage facility export registrations to lapse for several weeks into March.

Lapsed registrations did not mean that goods could not be exported from those facilities, but the uncertainty levels increased, and the signal was clear. Joe Schuele with the U.S. Meat Export Federation, told Reuters, “The risk involved in shipping product with a looming expiration date is high. The situation is certainly dire if [registrations for] these plants are not renewed. The situation has the attention of every exporter.”

As any operator who has gone through the process of obtaining a Chinese export license knows, it is challenging to obtain and comes with a degree of uncertainty over when it might be revoked for reasons that are not always apparent. Tensions have already subsided from their high point in March 2025, and U.S. exporters and cold chain operators have a sense of uneasy relief. But no one expects calm waters anytime soon.

Hard Choices – United Kingdom and Europe

It’s been 10 years since the Brexit vote and five years since the United Kingdom formally left the European Union. It is difficult to underestimate the importance of food trade and cold chain logistics issues in the divorce negotiations. The United Kingdom and the EU never seriously considered imposing new tariffs on goods. Instead, the preoccupation was with nontariff-related rules and market protections.

In seeking to free itself from the obligation to follow European laws, the U.K. faced an obstinate refusal from the EU to grant special dispensations for how its food goods flowed across its borders. The result was a dramatic fracture in a highly integrated food supply chain.

Within the European single market, U.K., Irish, French, Dutch, and Belgian retailers could store food in a retail distribution center in one country and fulfil orders overnight in stores in another. U.K. food specialists, particularly small businesses, could place orders for one or two pallets and utilize a groupage network that delivers within hours or days across the continent. This all ended for U.K. exporters on January 1, 2020.

After that point, consignment moving from the U.K. into the EU had to be certified, customs-registered, and subject to likely inspection at the EU port of entry. The costs, delays, and uncertainties had immediate effects. Food exports initially froze, but as trade recovered, it became clear that they would not return to the previous levels. Furthermore, a third of U.K. businesses decided that it was not possible or cost-effective to sell goods to companies outside the country.

Fast-forward five years, and the U.K. and EU have agreed on a deal outline for a new Sanitary and Phytosanitary (SPS) agreement aimed at removing the certification and inspection requirements on both sides. The food industry has welcomed this move, but it comes with significant consequences. A deal is possible because the U.K. has essentially conceded to the EU’s original demands that it “dynamically align” with EU food rules indefinitely.

If the EU imposes new prohibitions on ingredients or production techniques, the U.K. must follow suit. This permanent agreement will severely limit the U.K.’s ability to make the kind of concessions other countries might expect in a new comprehensive trade deal. The United States is one of many major agricultural exporters that sees “European” regulatory standards as unjustified discrimination against their producers, especially in key cold chain categories, such as beef and poultry.

In the weeks preceding the U.K.-EU deal, the United States and the United Kingdom reached their own agreement, which resulted in a significant increase in the amount of beef both sides would allow to enter their markets, tariff-free. However, the new allowances were still a fraction of U.K. imports and did not come with any concessions on the regulatory prohibitions on the majority of U.S.-produced beef entering the market. On announcing their deal, the U.K. and U.S. leaders promised that it was an “appetizer,” with more ambitious agreements to come. However, now that the United Kingdom has agreed to stay bound by EU food rules, it’s unclear how much appetite the United States will now have for the main course.

The U.K. example illustrates the consequences, trade-offs, and hard choices involved in repositioning a country’s trade strategy. It shows that some of the most difficult challenges arise within the food and agriculture sector during this era of change, and it is cold chain operators that manage the consequences.

Poised to Win – Brazil and Australia

Australia has long been a world leader in growing its export markets. With over 70% of its farm production sold through exports, it must be single-minded and responsive in seeking to open and maintain markets for its produce. It is also uniquely positioned between the United States and China, both geographically and economically. Australian exporters suffered setbacks when the United States imposed a 10% tariff on their imports, but the Chinese market demand has more than made up for it.

It is therefore unsurprising that in April 2025, Australia exported record volumes of beef. However, experts will not rush to simple conclusions. Meat and Livestock Australia’s global supply analyst, Tim Jackson, told the Australian Broadcasting Corporation that, “The surge in export volumes was fundamentally because of record supply. Australia has a large herd, rising slaughter rates and carcass weights have been lifting consistently, so when measured in tonnes, our production is going up, and that good supply flows into exports.”

A pragmatic and realistic outlook prevails among Australian industry leaders. Official reports look to the “medium term,” predicting longer-term declines in volumes and values as consumer trends in meat consumption shift, trading relations stabilize into new patterns, and global competition intensifies.

Brazil is a relatively new arrival in the big leagues of global exporters, but its rise is rapid, and there are good reasons to be bullish.

On the eve of the significant U.S. tariffs announcement, Brazilian Agriculture Minister Luis Rua told the European news outlet EurActive, “Brazil is a reliable and stable partner – one that ensures competitive products that contribute, for example, to global food price stability. That’s why we are ready to support any country that requires an increase in Brazilian exports, for whatever reason – even geopolitical.”

Like Australia, Brazil does not employ a “wait and see” strategy for the potential trade fallout benefits. Notably, President Lula’s recent tour of Asian capitals secured new trade access deals for Brazilian meat exports in Japan, South Korea, and Vietnam. This, along with a breakthrough in the longstanding EU MERCOSUR trade agreement, shows that Brazil can succeed beyond trade growth with China and the United States.

However, perhaps Brazil’s biggest challenge in harnessing these opportunities is its ongoing challenges in infrastructure and supply chain.

A working group of leading port operators has launched a “Manifesto for Innovation” in the maritime and port sector, highlighting how the shortcomings in Brazil’s port network are hindering trade. This includes long docking wait times of five days or more, compared to the U.S. average of two days, as well as high customs clearance times and costs of $862 and 49 hours, versus the $136 and 12.7-hour average across the Organization for Economic Co-operation and Development (OECD) countries.

As the country rushes to cope with its first major outbreak of HPA1 influenza, its ability to provide reassurances on its containment and control strategy will prove its readiness to become a major player in cold chain exports.

Caught in the Middle – Africa

Many African countries were faced with high tariff levels on the “reciprocal tariffs” list presented by the U.S. President on so-called “liberation day.” It was a stark illustration of a shift in U.S. policy, which for decades has seen maintaining open and tariff-free trade routes for some of the world’s poorest nations as a core strategy in its global foreign policy. Coupled with the dramatic and immediate scaling back of U.S.-funded aid and development programs, this will have far-reaching consequences for food trade policy across Africa.

Since 2000, 34 countries in sub-Saharan Africa have benefited from the Africa Growth and Opportunity Act (AGOA), which allows more than 6,800 products, including minerals, chemicals, fruits, and vegetables to be imported into the U.S. market duty-free. AGOA products represent 29% of total U.S.bound exports from the 32 African countries that are party to the act. South Africa, the biggest exporting economy, is also the biggest beneficiary, utilizing tariff-free quotas on products such as wine, citrus, soybeans, sugar cane, and beef.

AGOA is up for review in September, but few African leaders hold out hope for its renewal. “AGOA is finished. It is dead in the water,” says Alex Owino, a former advisor to Kenya’s Treasury under President Uhuru Kenyatta.

The focus shifts instead to the potential for bilateral deals and arrangements. Countries will look for ways to mitigate the tariff walls being erected in the United States. However, the influence of China as an investor and trade partner has grown over the past two decades, and the further extraction of the United States will only help reinforce strong links.

Also, in the food and horticulture sector, links to Europe have always been more important in terms of value and volume, and many countries in the region retain preferential tariff and quota policies. If U.S. routes close, this would be a prominent place to look for trade diversion opportunities.

However, for most Africans, the real opportunity is in growing trade within the neighbourhood. Failure to find ways to remove trade barriers between neighbouring countries is holding Africa back. As Kennedy Mukulia of the Africa Union Commission argues in a recent piece for the Daily Nation, “IntraAfrica trade hovers below 20% of total food commerce, largely because trucks spend more time at border posts than on the tarmac.”

The African Continental Free Trade Area holds many of the answers to breaking down these barriers by establishing enforceable rules and mechanisms to hold countries accountable for how they manage their border controls.

If the United States’ actions cause African nations to accelerate the inevitable path towards greater economic integration, it may inadvertently push the biggest step forward in food security and agricultural prosperity that the continent has ever seen.

Beyond Tariffs

There is no doubt that the recent interventions of the Trump administration have heightened the drama and uncertainty that permeate the global trading system. However, as the examples here demonstrate, the issues for food businesses extend well beyond a short-term tariff war.

Recent months have wreaked havoc on supply chain forecasting. However, if this situation compels some to confront the underlying issues – for example, encouraging businesses to understand the value of investing in their supply chain resilience or forcing governments to tackle the frictions that hinder the flow of food trade with desired markets – then there are reasons to be hopeful more opportunities will emerge for cold chain operators across the global food supply chain.

Media Contact

For media inquiries, please contact: Lindsay Shelton-Gross, Senior Vice President, Global Communications, Marketing and Strategic Initiatives, Global Cold Chain Alliance.