Adapting to emerging challenges and grasping new market opportunities.

Cold chain markets in the United States and Canada have experienced particularly high visibility over the past 18 months, as Lineage’s initial U.S. public offering coincided with the completion of several major new facilities and expansions in both countries.

Market Growth

The industry had previously flown under the radar, however, the past two years marked a milestone reached following a long period of market growth. Analysts point to multiple growth drivers, including the surge of online grocery shopping. In the United States, 28% of shoppers now buy groceries online at least once per month, according to Capital One Shopping research, and in Canada, urban centers like Toronto and Vancouver are leading increased demand for quick and convenient delivery.

In addition, U.S. frozen food sales jumped by 22% in 2020 and have stayed well above pre-pandemic levels, according to Wide Moat Research. Meanwhile, Canada’s population growth has been robust, and a recent IQVIA white paper found that 45% of the top 20 U.S. drugs by sales need cold storage.

These are strong numbers and a basis for confidence in the medium term. However, Eben James, Chief Executive Officer of Ontario-based Trenton Cold Storage, points out that a shift linked to global economic uncertainty has begun. “Overall, there is a move now to a more conservative approach to investment, and a more conservative mandate from private equity and pensions. At the same time, businesses have started building private space again over the past two or three years: there is a softening in the 3PL market.”

Demand and Capacity

James considers that, overall, the current demand for cold chain services in Canada is holding fairly flat. While some customers’ cold storage needs have reduced, demand for Trenton’s small order pick has been growing stronger.

A similar stability in demand is reported in the United States. Stephen Draper, Cofounder and Chief Operating Officer at Envision Cold, assesses that the current demand for cold chain services is not materially different from that experienced in recent years.

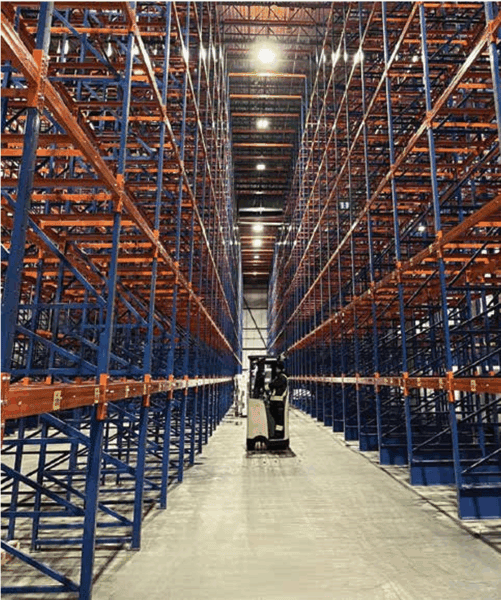

In terms of cold storage capacity, GCCA’s most recent “Top 25” report on refrigerated warehousing and logistics providers (published in April 2025) found that the Top 25 members in North America are operating a combined capacity of 5 billion cubic feet (141.5 million cubic meters). This has risen by 629 million cubic feet since 2024.

A number of major projects, both completed or underway, are contributing to this significant and ongoing increase in storage capacity. In August 2025, Americold announced the opening of a 335,000-squarefoot import-export hub in Kansas City, Missouri, in partnership with Class I railroad Canadian Pacific Kansas City. And Miami’s position as a major gateway for perishable goods into the United States is set to be further reinforced with the opening of a cold storage and phytosanitary facility at Miami International Airport in 2027, part of a $141 million public-private partnership between the airport and PortMiami.

Canada is also seeing exciting new projects come to fruition. The recent acquisition by Congebec Cold Storage of Bradner Cold Storage is a strong signal of an intention to reinforce and continue growth in a Canadian owned business.

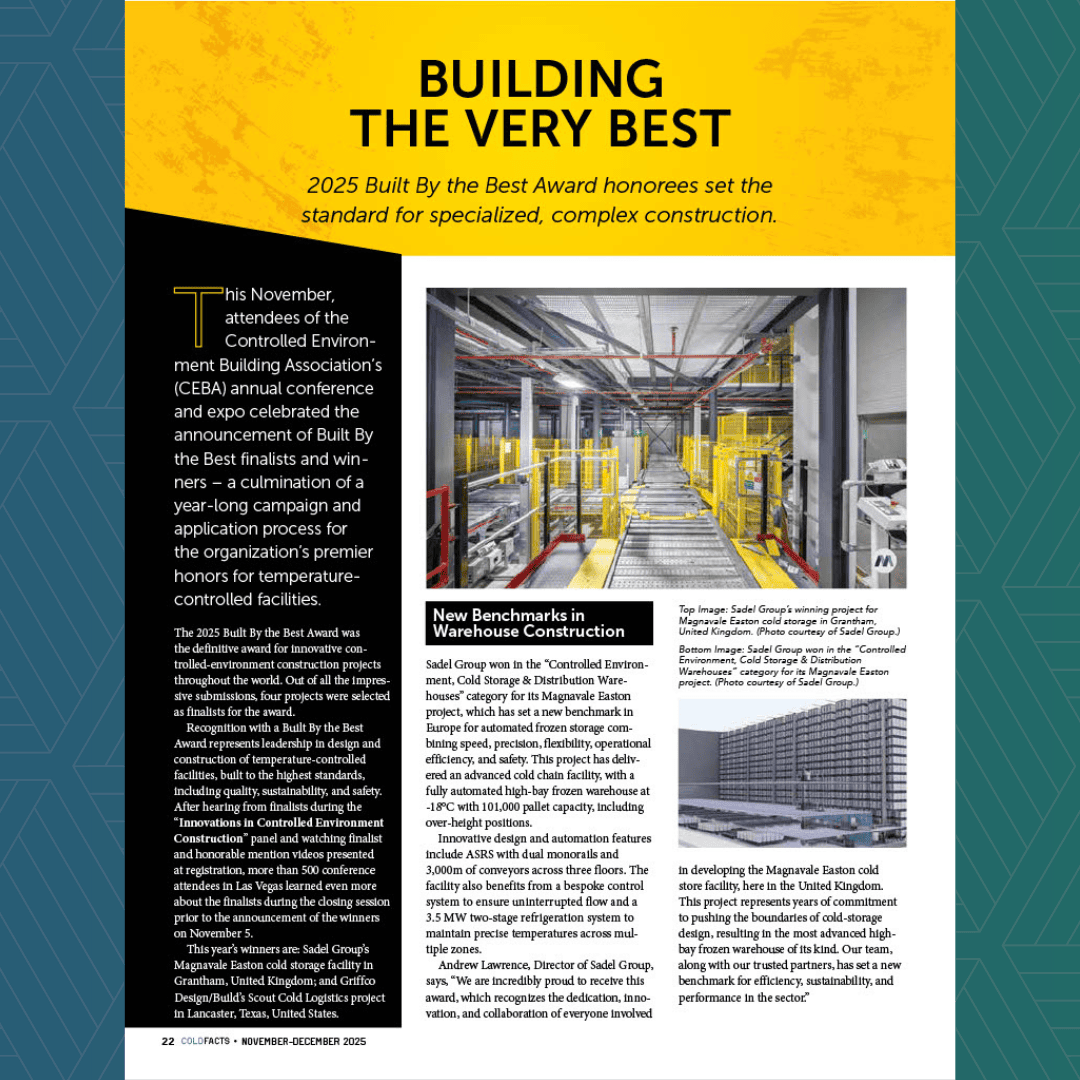

Similarly, Conestoga Cold Storage continues to push the boundaries of innovation with the opening of its new 96 million cubic foot facility in Halton Hills, and Trenton Cold Storage has added a further 26,000 pallet positions to its cold storage portfolio with a new state-of-the-art facility in Moncton, New Brunswick, in Canada.

International companies are also bringing major investments. Lineage announced earlier this year that recent acquisitions and expansion projects in Canada will grow its network by 13 million cubic feet and more than 68,000 pallet positions; Americold announced in May 2025 that it is breaking ground on its first import-export hub in Canada, serving Port Saint John in New Brunswick; and NewCold is constructing a $222 million automated facility in Alberta.

With significant capacity expansion in recent years, industry observers have noted a change, in both Canada and the United States, from undersaturation of the cold storage market to an emerging position where substantially more space is now available in the market. “It’s a pivotal moment for the industry,” Draper explains. “The major events over the past five years have driven a significant influx of new capacity into the market. We will need time to absorb the excess capacity – at least the next one to two years. While older warehouse facilities in strong markets still bring meaningful value, some outdated and obsolete facilities will likely need to be repurposed. This, combined with steady consumer growth, should help restore occupancy rates to more historical levels.”

International Trade

A range of impacts linked to the Trump Administration’s international trade policy are emerging for the cold chain market in Canada. Changes occur within the context of a solid perishable goods trade position. Data from Statistics Canada shows post-pandemic volume growth for many Canadian exporters of perishable foods, and imports of perishable foods have generally been stable since the start of the pandemic (although meat imports have seen more year-on-year volatility).

James reports that the effects of the recent tariff changes between the United States and Canada have been mixed. “We have garnered some business because of tariffs, and we have lost some business because of tariffs,” he says. “The lost business was in mature products where tariff changes were the straw that broke the camel’s back. I think we will see North American supply chains increasingly moving to an approach where product for Canada is produced in Canada, and product for the U.S. is produced in the United States – it’s a move from globalization towards regionalization.”

Draper also reports notable impacts for the U.S. cold chain industry as a result of changing tariff policy. “The most consistent feedback we hear from customers is that they struggle to plan effectively due to the uncertainty and frequent shifts in tariff policy. The constantly changing narrative makes it difficult for them to make confident deployment decisions, which often leads to hesitation and delayed action.”

GCCA Senior Vice President of Strategy, Partnerships and Policy Shane Brennan notes, “There is no doubt that the recent trade tensions between the United States and Canada have had operational impacts on trade flows and consumer-demand patterns. However, at times of trade tension and disruption, quality logistics companies prove their worth, and cold chain businesses on both sides of the border have done just that.”

Considering the medium-term impacts of tariff policy changes, Brennan remains optimistic. “The industry is anticipating suppression in consumer demand driven by cost inflation and shifts in purchase and supply. However, the trade links between the United States and Canada remain of fundamental importance to both economies. If trade remains difficult, then manufacturers, retailers, and traders will be best served by investing in ensuring they have resilience built into their supply chains.”

Cold Chain Outlook

Looking to the future, James anticipates cold chain operators will return to a laser-like focus on energy supply and costs. “This issue is off the front-burner for now,” he explains, “but I expect that how cold chain operators consume and generate energy will become a high priority for our industry again in the years ahead.” He also foresees inflation in the United States and in Canada, with pressure on interest rates and increased costs for customers due to tariffs and a reduction in labor availability in the United States.

For Draper, longer-term growth opportunities in the United States remain strong. “Many markets still require additional infrastructure, and the overall upside in cold chain demand continues to outweigh the short-term challenges certain regions are facing.”

There is no doubt that this is a time of change across North America, but the temperature-controlled logistics industries, in both the U.S. and Canada, are well-positioned to adapt, to address emerging challenges, and to seize new market opportunities.

Media Contact

For media inquiries, please contact: Lindsay Shelton-Gross, Senior Vice President, Global Communications, Marketing and Strategic Initiatives, Global Cold Chain Alliance.