How ports and shipping lines are navigating tariffs, supply chains, and maritime cargo on choppy seas.

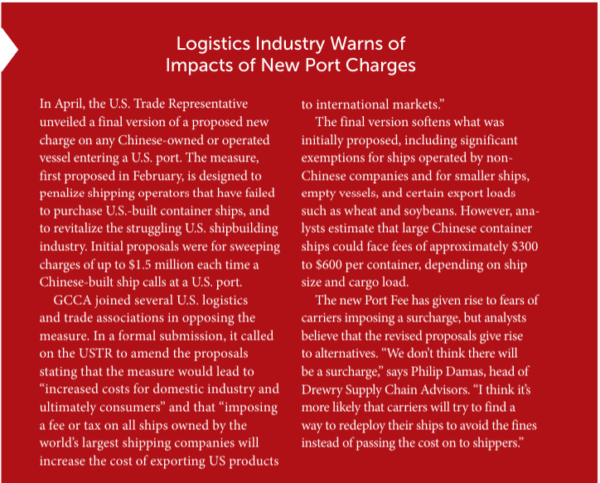

President Donald Trump has begun his second term in office with ambitious plans to overhaul U.S. trade policy, aiming to achieve various economic and non-trade-related objectives. Long favored by the President, tariffs are his go-to tool. They have become a significant issue for businesses and the international economy, and tariffs are expected to remain the dominant topic in global commerce throughout 2025.

The surge in tariff activities has caused considerable disruption in global supply chains. As the situation continues to evolve, its immediate effects are evident. Businesses are navigating uncertainty, and supply chains are encountering new complexities. But it’s the cargo seaports that serve as the canary in the coal mine.

“In many ways, we serve as the bellwether for what is about to happen in the economy, because businesses, retailers, and consumers stock up their inventories and prepare for the summer consumption season,” said Cary Davis, President and CEO of the American Association of Port Authorities (AAPA) and an advisor in President Trump’s first administration. “They are making purchasing decisions at the moment that will affect what the shelves look like weeks and months from now.”

AAPA: Headed for Positive Resolution

In a C-SPAN interview in early May, Davis stated that the first months of 2025 saw an explosion of record-breaking imports and exports, as businesses and consumers accelerated their buying decisions, anticipating that tariffs would likely be imposed. “Now, we are basically facing a cliff.”

Davis points out that inventories will vary from industry to industry based on consumer buying habits and the nature of the commodity. “Overgeneralizing, I think most analysts are saying that between five and seven weeks (mid-summer), we will probably see significant price increases and shortages of household consumables that customers expect to buy.”

Seaports are critical infrastructure, and seaport managers make billion-dollar decisions on a monthly and yearly basis about how to recapitalize the port facilities’ infrastructure. “It is hard to make those decisions when the trading landscape is uncertain, there are inflationary pressures on construction, and you don’t know the cost for constructing a new dock, piling, pier, or dredging project 12 or 16 months out,” said Davis.

He notes a surge of interest in free-trade zones, geographical areas often located in ports where businesses can bring in imports or goods without introducing them into the economy. “You just leave it there until you have a better sense of the tariff rate, and then you can bring it into the country.”

Davis believes the warehousing industry is faring well under the circumstances. “Just like during the pandemic when the consumer downstream and tax situation were uncertain, all sorts of warehouse facilities, bonded and free-trade zones, can hold their customers’ goods at bay until they have a clearer picture of what the playing field will look like.”

Davis doesn’t think there’s a need to worry about panic buying at this time. “I think we are headed towards a positive resolution of the angst we might be feeling in the trade community.”

Port of Los Angeles: Uncertainty Remains

- Port of Los Angeles ranked as the Number 1 container port in the Western Hemisphere for 25 consecutive years (2000-2024)

- Port of Los Angeles ranked Number 18 in the world (based on 2023 throughput)

- San Pedro Bay port complex ranked Number 9 in the world (based on 2023 throughput)

The ports of Los Angeles and Long Beach had already started to see a sharp slowdown in volumes as the first vessels arrived from China, subject to the 145% tariff.

Posting on X, Port of Los Angeles Executive Director Gene Seroka wrote, “The 90-day pause and reduction in tariffs is welcome news to consumers, American businesses, workers, and the supply chain.”

At the Port of Los Angeles’ monthly media briefing in May, it was apparent that ports and shipping attract attention during uncertain economic times. Seroka said, “We have over 80 media outlets participating today…the largest media turnout in our six years of monthly briefings.”

The subject of uncertainty was tariffs and trade flows, which are crucial to the U.S. economy (as well as those of its trading partners), but are difficult to predict during the current “pause” or temporary reduction phases, during which background discussions are presumably underway with the United States’ trading partners. During the webinar, Seroka repeatedly qualified his answers to media questions by reiterating, “The uncertainty remains … tariffs are still elevated.”

While tariffs on Chinese imports are no longer at 145% for the next 90 days, they remain at a substantial level of 30%. “Even with this announcement, tariffs remain elevated compared to April 1,” Seroka says. “This 90-day reprieve is not a long runway.”

Regarding upcoming deadlines in July and August when present pauses expire, Seroka said, “These will lead to trepidation, not knowing where we’ll all land.” Rather than making specific forecasts during the media briefing, Seroka referred to “a stop-start focus” in various trade negotiations, and an “information whipsaw.”

To avoid further uncertainty and trade disruption, Seroka suggested both sides should work together swiftly toward a long-term agreement. “Additionally, it’s important for the United States to work with other nations to reduce existing tariffs.”

Maersk: Trade Like Water Finds a Way

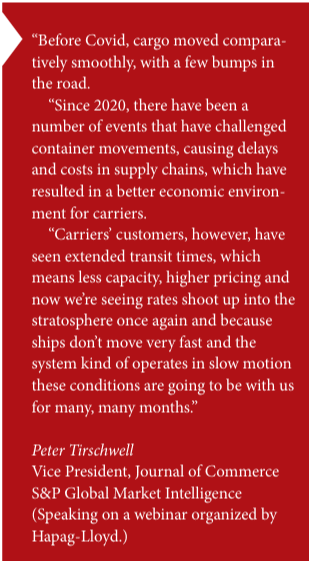

Despite the uncertainty tariffs create, Lars Karlsson, Global Head of Trade and Customs Consulting at Maersk, notes the resilience and adaptability of trade in response to changing regulations and tariffs.

“Trade, like water, will find a way. This will not go away,” Karlsson said during a recent interview for Maersk’s “Beyond the Box” podcast. “It is better to be ready now and not to wait for solutions that will come later. Companies need to invest in this, talk to the right partners, and they need to have the networks to make it happen.”

Karlsson advocates looking at partnerships and the networks your company already has established, including those internally, to ensure you meet the demands of today and tomorrow, not just those of yesterday. “Stay agile, stay with your partners, and ensure you have access to the data you need. Look for solutions that can serve you in multiple markets and for multiple risks and regulations that are configurable for your situation, that provide risk screening upstream as early as possible to detect and avoid risk that can be costly from a trade compliance perspective, and that can adapt to uncertain times and fast-changing requirements.”

The latest news in global trade has introduced significantly more uncertainty to 2025 than was expected at the start of the year, Karlsson acknowledges. He says recent conversations between Maersk and businesses have shed light on several shared concerns. “Since the start of 2025, we’ve seen an almost 1000% increase in the number of inquiries from clients. This highlights the complexity of the environment businesses now have to navigate.”

Karlsson said he wasn’t surprised to hear many businesses are worried about rising costs due to tariffs and the resulting delays in their supply chains. He adds that some companies are shifting their sourcing to other countries to mitigate these costs. Conversations with different businesses also highlighted a heightened need for customs compliance guidance to effectively navigate the new tariff landscape.

“Partners with solutions for multi-regulations, multi-markets, and the ability to configure to the production and sales pattern of a company – from the journey through the market to the end consumer, are important during this time,” explained Karlsson. “Supply chain visibility, customs compliance excellence, and utilizing available data all come down to having the right partners.”

Media Contact

For media inquiries, please contact: Lindsay Shelton-Gross, Senior Vice President, Global Communications, Marketing and Strategic Initiatives, Global Cold Chain Alliance.