Significant and dynamic change is occurring across the global trade landscape. The Global Cold Chain Alliance (GCCA) tracks trade and tariff developments and announcements across multiple regions and markets. Information is updated regularly.

Questions? Please contact Shane Brennan, Senior Vice President, Strategy, Partnerships and Policy at sbrennan@gcca.org

RECENT UPDATES

China reduces anti-dumping tariffs on EU pork imports

China has issued its final ruling in an anti-dumping investigation into European Union pork, significantly reducing the duties applied t EU exports. From 17 December, China will impose tariffs ranging from 4.9% to 19.8% on EU pork imports for five years, down from the 15.6%–62.4% rates set in a preliminary decision in September. The revised measures apply to pork imports worth over US$2 billion annually. Importers will receive refunds for the difference between the provisional and final rates paid since September.

The investigation, launched in June 2024, affects major EU exporters including Spain, the Netherlands and Denmark. In 2024, more than half of China’s US$4.8 billion pork imports came from the EU, with Spain the largest supplier by volume. Most Spanish exporters will face a tariff of 9.8%, with some firms receiving lower rates. The European Commission criticised the investigation as being based on insufficient evidence and stated it is assessing compliance with WTO rules, while reaffirming its intention to defend EU exporters. The duties are applied in addition to the existing most-favoured-nation tariffs of around 12% for many pork products. China is also conducting an anti-subsidy investigation into EU dairy exports, due to conclude in February 2026, and has already imposed tariffs on EU brandy.

United Kingdom: UK–South Korea Trade Deal

In December 2025, the UK and South Korea concluded an upgraded Free Trade Agreement, securing long-term tariff certainty and improved market access for food and agri-food products. The agreement locks in zero tariffs on around 98% of tariff lines, including chilled and frozen seafood, meat, dairy, processed foods and beverages, removing the risk of duties re-emerging under post-Brexit continuity arrangements.

Of particular relevance to cold chain operators, the deal strengthens customs facilitation and digital trade provisions, supporting faster clearance processes and reduced administrative friction for time- and temperature-sensitive goods. Updated rules of origin provide greater flexibility for processed food products with multi-country inputs, increasing the likelihood that UK exports qualify for tariff-free treatment. Enhanced cooperation on sanitary and phytosanitary (SPS) measures and biosecurity should help minimise inspection delays for animal-origin products, improving reliability for refrigerated and frozen supply chains.

The US and Chinese Governments have both taken action to suspend the port fees imposed as a result of the US action taken in response to the Section 301 ‘unfair trade practices’ investigation. Both suspensions took effect at 00:01(EST) on November 10th. This means that companies operating Chinese vessels calling at US Ports or US companies calling at Chinese ports will not face the levies that had taken effect on October 14th. The suspension was agreed by Presidents Trump and Xi at their Summit meeting on November 1st and allows time for ongoing trade negotiations between the two economic blocs. Read statement from the US Trade Representative Office here.

Read more from GCCA on U.S. statements on the status of trade negotiations with the following members of the Association of Southeast Asian Nations (ASEAN) – Malaysia, Thailand, Cambodia and Vietnam.

Recent Tariff Announcements Round Up

Over the course of 2025 the United States has made significant and ongoing changes to tariff policies – these are grouped into three categories:

- Taxes imposed on imports from other countries – this includes a baseline 10% tariff, with a variety of ‘reciprocal’ tariff rate based on a calculation of net trade imbalance or other relevant factors as set out by the US Administration (in some cases the US has reached bilateral trade accommodations, in others there are escalating political tensions)

- Duties on specific products without regard to their origin, normally linked to supporting a domestic US industry (these include steel, aluminum, autos and auto parts, copper parts, timber and lumber, furniture, heavy duty trucks, with others under consideration)

- Cold chain impacts - according to the USDA Foreign Agricultural Service in the first half of 2025 total U.S. exports across beef, pork, poultry, seafood, fresh & processed vegetables, and fresh & processed fruits total global exports decreased by 3% and imports increased by 4% compared to the same period in 2024.

Categories that have seen the biggest growth in imports in H1 2025 include beef and beef products (27%), poultry and eggs (10%) and seafood (10%> all export categories have seen declines except seafood that saw a 10% increase

U.S and China impose fees on container ships landing at their ports

Actions announced earlier this year first by the United States to penalize shipping lines that own, operate and purchase chines bought container ships take full effect from today. China has imposed similar reciprocal measures. These policies have impacted on the routing and planning of the world’s major container shipping lines and will have an inflationary impact on container rates for refrigerated cargo and therefore on the cost of importing and exporting goods.

U.S. port fees on Chinese-linked vessels (from 14 Oct 2025)

- Under a Section 301 action, the U.S. will impose “special service fees” on vessels built, owned or operated by Chinese entities calling at U.S. ports.

- The finally adopted rate is US $46 per net ton (reduced from earlier proposals) for affected vessels.

- Each vessel will be charged no more than five times per calendar year, on a per-voyage basis.

- Some concessions have been made: exemptions for certain categories (e.g. smaller vessels, or voyages in ballast) and adjustments in rates for vehicle carriers.

Chinese countermeasures (also effective 14 Oct 2025)

- China announced reciprocal “special port fees” on vessels with U.S. links: those built, owned, operated, flagged in the U.S., or entities with ≥ 25 % U.S. equity/control.

- The initial rate is RMB 400 per net ton, to rise gradually (to RMB 1,120 by 2028).

- China exempts vessels built in China, even if they meet U.S. nexus criteria otherwise.

- The fee is collected at the first Chinese port of call per voyage and capped at five voyages per year.

- Declaring ownership and control (with U.S. equity thresholds) prior to port calls will be required, and failure to pay may block cargo operations.

- In addition, China has sanctioned five U.S.- linked units of South Korea’s Hanwha Ocean for alleged involvement in U.S. maritime investigations.

Ecuador

Update 9th September

Ecuador And South Korea agree trade accord that will allow 98.8% of Ecuador’s exportable products to enter South Korea tariff free – this is seen as a likely boost to this major shrimp exporting industry and positive news following a recent decline in Chinese demand.

European Union

Update 10th October

The United States Department of Commerce has concluded an investigation into two major Italian produces that allegedly sold pasta at unfairly low prices – known as dumping – between July 2023 and July 2024. It has recommended an additional tariff duty on imported Italian pasta of 91.74%, which would be on top of the 15% general import duty imposed earlier this year. If it proceeds they will take effect in 2026.

The US currently imports more than $800m in pasta from Italy every year and is one of the top three export markets for the product. The EU is supporting the Italian government in contesting the decision.

India

Update 27th August

The United States has increased the total effective import tariff on Indian goods to 50% - an increase on the 25% imposed in April 2025. This has been justified as a response to the continued purchase on onward sale of Russian oil. Trade talks between the two countries will continue

Africa

Update 30th September

As widely predicted the Africa Growth and Opportunity Act (AGOA) that facilitated tariff free access to the United States market for exports from countries in sub-Saharan Africa has expired. The end of this agreement follows the range of reciprocal and sectoral tariffs imposed by the Trump administration in 2025.

Despite the expiration there have been indications of political support for an extension of renewal of the agreement from within Congress and the Trump administration. However, it is not clear if that will now come to pass, especially in light of the current government shutdown in the United States.

AUGUST 1, 2025 | U.S. TARIFF DEADLINE OVERVIEW

Update: August 1, 2025

On Thursday, July 31, President Trump formally announced higher tariffs against more than 60 U.S. trading partners — just hours before the administration's self-imposed midnight deadline. An executive order listed out tariff rates for imports from dozens of countries, including a handful that have cut trade deals with the administration and dozens that haven't reached a deal yet. The duties range as high as 41% for Syria and 40% for Laos and Myanmar, while almost no country's imports will face tariffs below 10%. The tariff rate on U.S. imports from Canada raised to 35% from 25%, effective today.

Also of note, on 7/31 President Trump postponed higher tariffs on Mexico, writing on social media that he had agreed to a 90-day extension with President Claudia Sheinbaum to provide more time to cut a trade deal.

See the list of additional reciprocal tariffs here.

Update: July 30, 2025

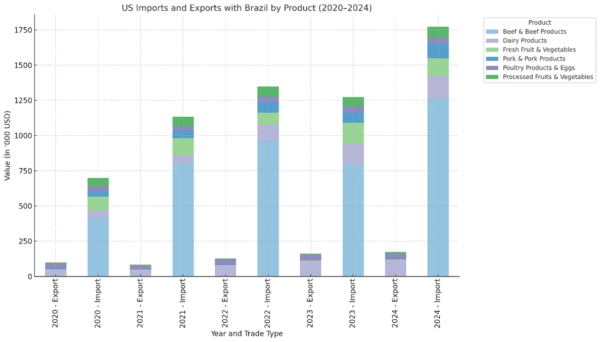

President Donald Trump delayed the implementation of 50% tariffs on Brazilian exports by seven days while exempting many products from the levy. The order would apply an additional 40% tariff on the baseline 10% tariff from April 2nd. But not all goods imported from Brazil would face the 40% tariff: Orange juice, civil aircraft and parts, aluminum, tin, wood pulp, energy products and fertilizers are among the products being excluded.

Update: July 14, 2025

On August 1, 2025, a sweeping set of new U.S. tariffs is scheduled to take effect. Over the past three weeks, the U.S. administration has issued formal tariff warnings to more than 23 countries, triggering one of the broadest trade confrontations in recent memory.

With so many shifting developments, please read below a summary overview from GCCA, commencing Monday July 14, 2025.

What is Happening?

Since late June, the Trump administration has issued a wave of tariff warning letters, notifying trading partners that import duties ranging from 20% to 50% will be imposed unless new bilateral agreements are reached. The deadline: August 1.

The measures target major U.S. trading partners, including the EU, Canada, Mexico, Brazil, Japan, India, and more than a dozen others across Asia, Africa, and Latin America.

Cold Chain Implications (Key Countries)

Mexico / Canada*

Goods covered by the USMCA free trade agreement were initially included in the generalized tariff imposed on March 4 but were later excluded by an Executive Order on March 6. As a result, major cold chain categories—animal proteins, seafood, fruits, and vegetables—were exempted. Pharmaceutical products are also excluded.

The assumption, though not officially confirmed, is that these goods will remain exempt (i.e., 0% tariff) after August 1 if the new generalized tariff is enacted.

Nonetheless, existing tariffs on steel and new tariffs on materials critical to cold storage construction, refrigeration components, and other cold chain operations could lead to inflationary pressures.

European Union (updated July 28)

The Presidents of the United States and the European Commission have announced a new 'framework trade deal'. Under the agreement, the U.S. will apply a 15% universal tariff on most goods imported from the EU, with some exemptions still to be finalized. In return, the EU will cut most tariffs on U.S. goods to zero.

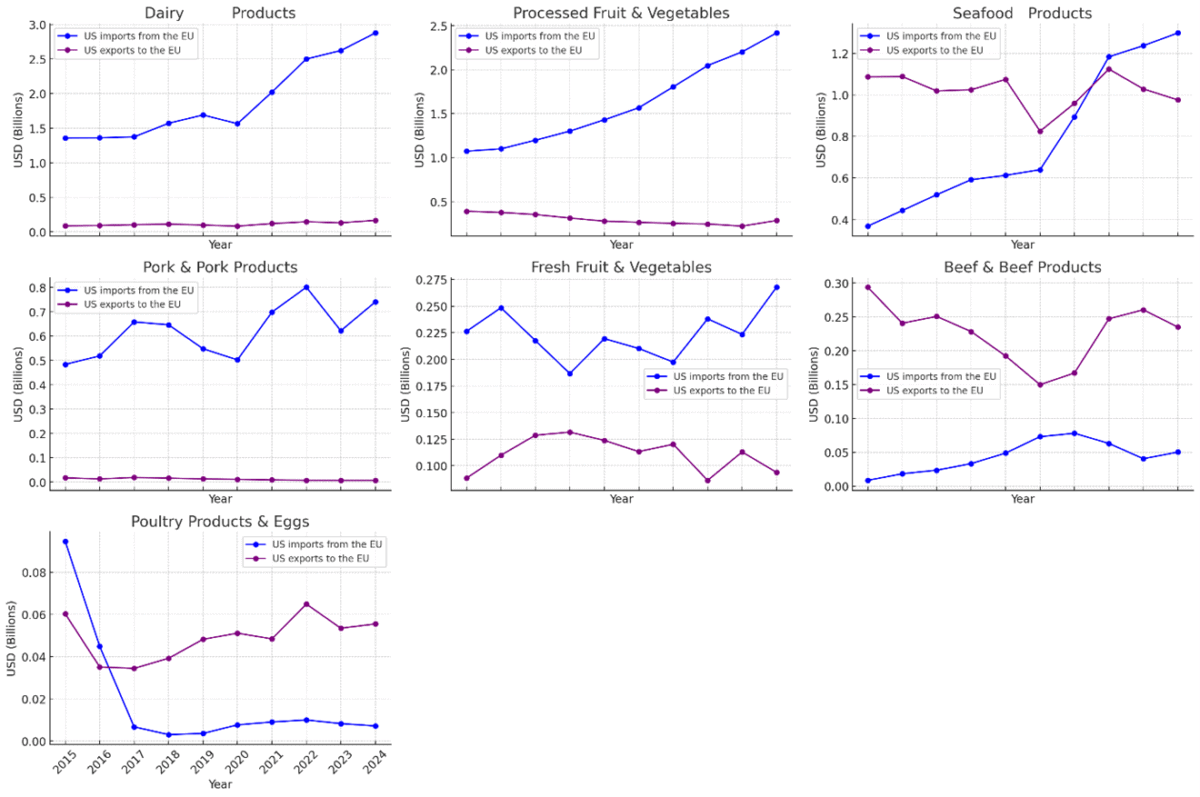

This marks a sharp increase from the pre-2024 average U.S. tariff of 4% on EU goods and is up from the 10% rate imposed since March. While the 15% tariff is lower than the 30% threatened recently, it’s higher than the 10% rate currently applied to the UK.

The framework signals future talks on agricultural tariffs, with a goal of eliminating duties in some categories — though not on sensitive items like beef and poultry.

Importantly, the deal does little to address non-tariff barriers that continue to block key U.S. exports, including hormone-treated beef and chlorine-washed chicken, due to strict EU food regulations.

The likely outcome: higher costs for U.S. importers and consumers, especially across cold chain categories like dairy, seafood, and processed produce. However, with similar tariffs now in place across multiple trade partners, the broader impact on demand remains uncertain.

Trade Flow Highlights (USD, billions) - Charts below show the U.S. remains a net importer from the EU in several key sectors.

- Read the United States Statement on the Deal Here

- Read the European Union Statement on the Deal Here

Brazil

The U.S. recently proposed a higher tariff on Brazilian goods, prompting a strong retaliatory response. Despite both countries being major agricultural exporters, bilateral trade is relatively modest, with a trade deficit favoring Brazilian exports.

The more significant implication for cold chain is a prolonged dispute between these two major exporters, which may result in rivalry for growth in third-country export markets where the two compete. Both nations are actively pursuing new trade alliances, particularly in China and ASEAN countries, aiming to expand market share for their agricultural exports.

India

There is growing speculation that the U.S. and India will reach a deal that would substantially reduce or eliminate the proposed tariffs — originally set as high as 20% — on U.S. imports from India. The U.S. has long aimed to open the Indian market to its agricultural goods by lowering average applied tariffs (currently around 39%) and easing non-tariff barriers like dairy certifications and GMO restrictions.

In the cold chain space, potential U.S. export growth lies in dairy and poultry. However, India has historically resisted market liberalization in agriculture due to strong domestic opposition, national food security concerns, and regulatory standards.

India’s export growth potential includes basmati rice, seasonal fresh fruits (especially mangoes, pomegranates, and bananas), and seafood such as shrimp. A trade deal could significantly benefit these sectors, particularly if high tariff barriers remain in place for seafood export competitors like Japan, Thailand, Vietnam, and South Korea.

Japan - (updated July 23rd)

Announcements made on July 23 suggest that the United States and Japan have reached a framework agreement that will see tariffs on goods imported from Japan into the United States being subject to a 15% general tariff. This is an increase from the 10% in place since March 2025, and a significant increase from the ~3% effective tariff rate imposed pre 2025, but less than the 25% threatened as part of the so-called ‘reciprocal tariffs’ scheduled to be enacted by the United States on 1st August.

Whilst the general agreement will see a number of existing tariffs on goods imported from the United States into Japan reduced to zero, the Japanese Prime Minister has stated that this will not include agricultural products which will continue to implement the tariffs and quotas agreed in the United States/Japan trade agreement (USJTA) that came into effect on the 1st January 2020.

The only adjustment referenced in the meda announcement related to agriculture will be in the tariff-free quota entitlement for US rice exports.

EXPLAINER - Agricultural Trade Provisions in the 2020 USJTA

Beef exports saw one of the most meaningful changes. Japan’s previous 38.5% tariff on fresh and frozen U.S. beef is being reduced gradually to just 9% over 15 years. Although a safeguard mechanism still applies if import volumes spike, the overall trajectory is one of greater access and lower costs. Similarly, tariffs on pork are being phased out, with muscle cuts becoming duty-free by year nine and processed pork products by year five. Variable levies and “gate price” systems that previously complicated trade are also being scaled back.

In the poultry sector, Japan is eliminating tariffs over a 10-year period. Seafood exporters are also benefiting from progressive reductions. Tariffs on many fresh and processed seafood products are being phased out, with full duty-free access expected within 5–10 years, depending on the product category.

Fresh and processed fruit and vegetable exports from the U.S. have received a major boost. Items like almonds, walnuts, cranberries, sweet corn, and broccoli entered duty-free immediately under the agreement. Others, such as fresh cherries, oranges, and processed tomato products, are moving toward zero tariffs under scheduled reductions over five to nine years.

By 2024, over 90% of U.S. agricultural exports to Japan qualified for either immediate tariff-free access or had clear reduction schedules in place.

South Korea

President Trump also sent a similar letter to South Korea on July 7. The key distinction in trade terms is that South Korea is a major importer of U.S. agri-food products, including beef, pork, dairy, and fruits. The U.S. is South Korea’s largest food supplier, benefiting from a zero-tariff agreement.

The existing trade deficit is driven by unrelated sectors, particularly automotive and electronics.

Negotiations are ongoing to reach a new arrangement before the August 1 deadline.

Indonesia

On July 15–16, 2025, the United States and Indonesia publicly announced that a landmark trade agreement had been reached. The U.S. agreed to reduce planned tariffs on Indonesian exports from 32% to 19%. In return, the general tariff on goods imported into Indonesia from the United States will be reduced to 0%. Indonesia also committed to major purchases of American goods, including $4.5 billion in agricultural imports.

Reports indicate that the $4.5 billion consists primarily of commitments to purchase U.S. wheat, corn, soybeans, and cotton, with no specific commitments related to cold chain products. Indonesia is not currently a large-scale importer of any cold chain food commodity; the largest category is dairy, valued at approximately $200–300 million annually.

A big tariff increase - it is important to note that while this agreement is framed as a major reduction in tariffs for Indonesian exports to the United States, it is only relative to the previously threatened higher rate. The U.S. imports approximately $2 billion worth of seafood (mainly shrimp and tuna) from Indonesia annually—these goods were subject to a 0% tariff until March 2025.

Regional Imbalance - Further to the update provided on July 8 (see “United States” section below), this means that three of the four largest Asian seafood exporters to the U.S. are now subject to tariffs in the 19–20% range. Thailand remains the exception, still facing the threat of a higher rate.

The Philippines (updated July 23)

On July 22nd the U.S. and the Philippines announced a trade agreement that suggests significant changes in the balance of bilateral agricultural trade across key cold chain categories. The deal appears to deliver zero tariffs on all U.S. exports to the Philippines—including traditionally protected cold chain categories like beef, pork, poultry, seafood, and fresh fruits and vegetables.

Historically, these sensitive U.S. exports faced tariffs of 30–50% or more under quota systems and safeguard rules. Assuming these barriers are fully removed, this opens up one of Southeast Asia’s fastest-growing consumer markets for US exporters with immediate, duty-free access for temperature-controlled meats, seafood, and produce.

The agreement is likely to have an opposite and negative impact on Filipino exports to the U.S. across the same categories. This mostly affects seafood, particularly tuna, shrimp, and processed fish, which is the Philippines’ largest cold chain export by volume to the U.S., valued at over $550 million annually. These exports will now face a 19% U.S. tariff, up from near-zero under previous MFN terms.

Other Philippine cold chain exports—such as frozen tropical fruit, processed pineapple, and prepared vegetables—may also be affected, though less severely given smaller volumes. Filipino exporters will need to absorb these new costs or pass them along, potentially impacting competitiveness against regional rivals.

2025 GCCA TARIFF INFORMATION & RESOURCE CENTER OVERVIEW

This document captures all Tariff Information and Resource Center updates by GCCA in 2025, including breaking news and key global information and resources by country/region. Regional information is available from the United States, Brazil, Canada, China, Ecuador, the European Union, India, Indonesia, Japan, Mexico, the Middle East and North Africa, East/West/Southern Africa, the United Kingdom, and Vietnam.

Previous GCCA Tariff Briefings

- March 11, 2025: Update on Tariff Developments

- March 5, 2025: New US Tariffs on Canada, China, Mexico

- February 10, 2025: Webinar Recording - Tariff Implications for the Cold Chain

- December 1, 2024: Trump Signals Tariff Plans