From COLD FACTS Magazine (Click Image)

Read Below:

Modernizing Our Refrigerated Fleets

Regulatory climate and ESG concerns are driving electrification of Heavy Goods Vehicles across the United States.

By Karen Thuermer

The transportation sector is increasingly required to cut emissions and go green. In fact, some U.S. states have set goals and specific targets for doing so.

California, in particular, has a goal of fully transitioning the trucks that travel across the state to zero-emissions technology by 2045, and is requiring that no more internal combustion engines (ICE) vehicles be sold in the state by 2035. California officials claim that while trucks represent only 6% of the vehicles on California’s roads, they account for more than 35% of the state’s transportation generated nitrogen oxide emissions and a quarter of the state’s on-road greenhouse gas emissions.

According to a report by McKinsey & Company, around seven million medium- and heavy-duty freight trucks circulate the United States today, and almost all are powered by ICEs. The Environmental Protection Agency (EPA) estimates that these vehicles generate more than 25% of total greenhouse gas emissions (GHGs) from the transportation sector.

For the last few years, California and its zero emission regulations by the California Air Resources Board (CARB), and other environmental, social and governance (ESG) goals have been the primary force behind refrigerated transportation companies investing in the electrification of fleets, explains Don Durm, Vice President of Strategic Customer Solutions at PLM Fleet.

“The Governor’s Executive Order N-79-20 requires that by 2035, all new cars and passenger trucks sold in California be zero emission vehicles. Under the order, CARB is mandated to develop and propose strategies to achieve 100% zero-emissions from medium and heavy-duty on-road vehicles in the state by 2045 where feasible and by 2035 from drayage trucks,” he says.

Meanwhile, another 15 states are supporting the rapid adoption of zero emission vehicles (ZEV) that will drive new regulatory requirements for these states. “California of course is the blueprint for this accelerated adoption of ZE commercial vehicles,” Durm says.

Durm emphasizes, however, that ESG is the main driver today for companies that may not even consider the regulatory environment. “Ninety-six percent of the top global corporations all have sustainability/ESG goals that are well defined and messaged,” he says. “Trading partners to consumers are all wanting to know what you are doing in this arena to do business with them. We have all become social buyers.”

He points out how today, there are even services that keep ESG scores. “These are an essential tool for investors to assess a company’s sustainability and ethical performance,” Durm adds.

These scores typically range from 0 to 100, with a score of less than 50 considered relatively poor and more than 70 considered good.

“Companies are not only evaluated by their return on the investment, but also their ESG scores,” he says. “Companies need to be aware of this important subject.”

Overwhelmingly Complicated

Switching to a ZE fleet, however, is not simple by any means. “In fact, the issue is overwhelmingly complicated,” says Peter Schneider, Director of Sales & Project Management, GirdMarket.

While trucking companies continue to invest significant money on research and development and introduce commercially viable products, the options are few on the trailer side of the business, Schneider reports. “There are probably about two to three products on the market that you can use. Each of them has problems,” he says.

The other problem is infrastructure at cold storage facilities that is required to handle the environmentally friendly trucks and trailers, such as chargers. In California, there’s also the reality of how utilities are going to be able to handle the additional electricity requirements, especially given the state’s history of rolling black outs, limited power supply, and high cost of electricity, Schneider points out.

“When you look at a facility – even a big, refrigerated facility – and you want to electrify a fleet of 20 to 50 classic trackers, the demand profile of that building is going to change by a magnitude of two to three – minimum,” he says. “Consequently, so many operators feel the odds are stacked against them. There is so much complexity, uncertainly and frustration in the market about how all of this is going to come together.”

Creating systematic and programmatic electrification systems also vary greatly depending on the size of the company. That’s because the conversation is not the same when talking to large, refrigerated distributors versus smaller companies. Among some of the issues that might be addressed are how to reduce a facility’s electrical load, and, in that process, consider the right location for accepting customer ZEVs that are dropping off and picking up shipments and require electric chargers.

“It’s less of a requirement for some that do not have a fleet to direct or operate,” Schneider says. “However, it’s a business/ revenue opportunity despite the fact it’s uncertain what it will look like and how much will be needed.”

Rapid Demand

Industry experts emphasize that despite the many complications, the need and demand for electrification systems is going to start happening quickly.

“The better positioned you are early on, the more revenue you will be able to take and the better you will be able to operate your business development,” Schneider stresses. “And, you’ll be better able to attract different types of customers over your competitors and help their needs. That is really where the thinking is.”

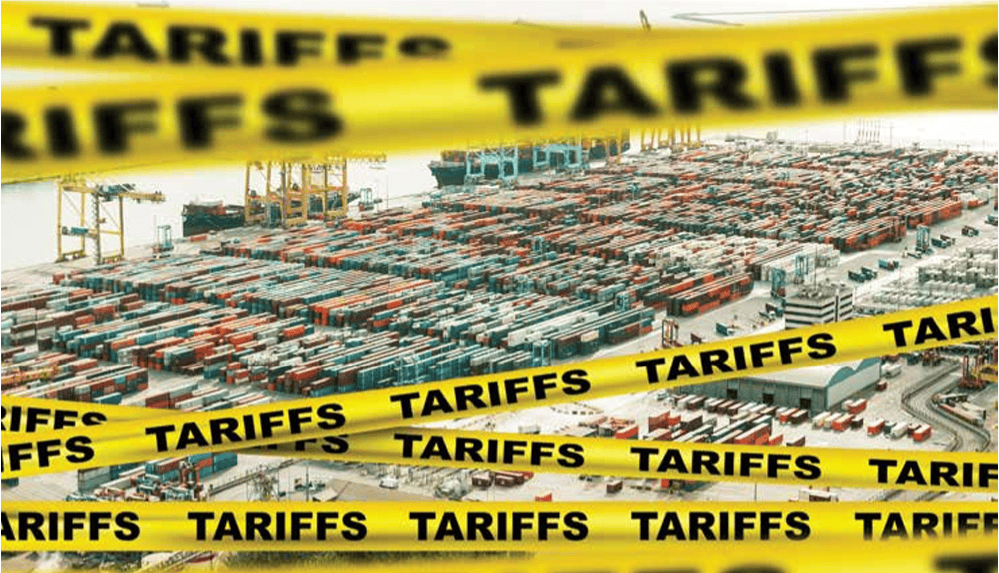

Not many entities are focusing on these developments with the exception of those in states with the most aggressive regulatory requirements such as California. And there it’s especially companies in California involved in drayage.

“They are basically saying that starting in January, you cannot register a new drayage vehicle that is not electrical,” says Schneider. “All existing ICE must be registered by the end of 2023 and grandfathered in. That means soon all drayage vehicles will be electrified.”

But a bigger question is, who holds the charging infrastructure? The ports, the drayage operator, the drop location? “It’s most likely a healthy mix of all,” says Schneider.

Ports are working hard on electrifying and creating charging infrastructure. But many in the industry question whether or not there will be enough. “What will the ports be able to offer in terms of the right level of support for this requirement they are creating?” Schneider asks.

His company is already in conversations with 3PLs that are operating out of the Ports of Los Angeles and Long Beach regarding installing Level 2/Level 3 chargers at their locations.

“The idea is to create a revenue model and see what happens,” Schneider says. “It’s not a massive investment and the hardware should work well during the next six years. Let’s set this up and create the right kind of risk of environment for your entity and see how we can start the pilot test.”

He further notes how many 3PL providers let hybrid trailers operators, of which there are many, charge these at their facility free of charge. Schneider suggests recapturing revenue that is being lost by letting operators bleed electricity and creating a new revenue.

Durm notes that a new regulatory environment is shifting the burden of energy expenses from fleets to warehouses.

“When you are utilizing ZE units that you plug in at the warehouse and no longer need to wet hose diesel, that cost needs to be accounted for on the P&L from the fleet to the warehouse,” Durm says. “If you are strictly a warehouse and you have no assets plugging into your warehouse, there must be a way to capture and pay for that so that you do not bare the expense.”

An answer would be adopting the Tesla charging business model – hiring companies to come in and build them for you and pay as you use them – Durm suggests. “One thing, industry needs to settle on one universal plug, or this will a nightmare,” Durm adds.

Funding Availability

Multiple funding options, such as grants and incentives, are available for transportation companies to move to these more sustainable models.

For tractor trailer operators, make-ready programs such as those in New York, California, New Jersey and Massachusetts help fund the infrastructure aspect of charger projects. But to be eligible, trucking companies need to prove they are taking ICE vehicles off the road.

3PLs/warehouse operators may be able to take advantage of specific grants, depending on their utility.

While some available funding such as California’s Clean Off-Road Equipment Voucher Incentive Project (CORE) has been used up, other available funding coming is the Inflation Reduction Act of 2022 tax credits for clean energy, which is intended to increase U.S. manufacturing of solar, wind and batteries and offer tax credits for U.S. electric vehicle production.

“It is important for companies to collaborate with the right partner to help them navigate the complexities of grants and funding for their projects,” says Durm. “It is nearly impossible for companies to figure this out on their own.”

But Durm likes to dwell on the fact that simply going green saves a company “green,” i.e., money. “It is our experience in the deployment of ZE refrigerated trailers over the past decade, with a number of companies, that operational efficiencies can save real dollars that far exceed what you can secure in funding,” he says.

Final Advice

Meeting regulatory requirements and devising a plan that makes business sense for the next 12 months is hard for most companies to conceptualize.

“A lot of fleet operators are struggling with this,” says Schneider. “When you extend that to a warehouse operator (3PL), it becomes even harder for them to wrap their heads around it.”

Many are not certain what the industry will look like over the next 18 months, so the uncertainty on how to deploy resources and capital is very confusing.

“Many are holding out to see where things stand a year into the drayage rule,” Schneider says. But the issue remains: how do providers set themselves up for success not too early and not too late.

Consequently, the biggest takeaway advice is for providers to partner with an experienced vendor to help manage the process and avoid the mistakes that would normally be made while implementing a ZE strategy.

Further, Durm emphasizes the need to understand how this will change management. “You really need to understand human behavior and how this will need to change,” he says. “Again, partnering with the right vendor will help guide you through this process.”