From COLD FACTS Magazine (Click Image)

Read Below:

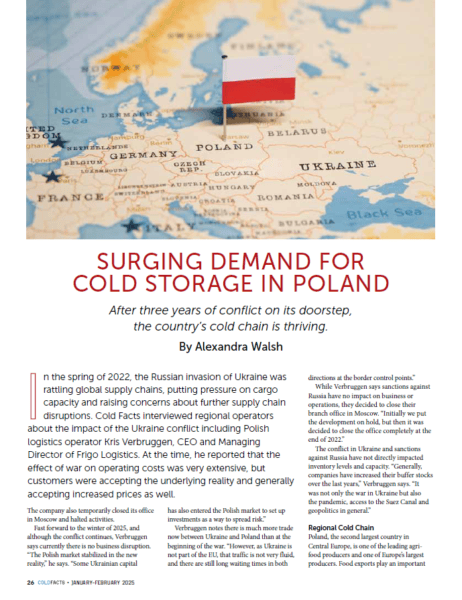

Surging Demand for Cold Storage in Poland

After three years of conflict on its doorstep, the country’s cold chain is thriving.

By Alexandra Walsh

In the spring of 2022, the Russian invasion of Ukraine was rattling global supply chains, putting pressure on cargo capacity and raising concerns about further supply chain disruptions. Cold Facts interviewed regional operators about the impact of the Ukraine conflict including Polish logistics operator Kris Verbruggen, CEO and Managing Director of Frigo Logistics. At the time, he reported that the effect of war on operating costs was very extensive, but customers were accepting the underlying reality and generally accepting increased prices as well.

The company also temporarily closed its office in Moscow and halted activities.

Fast forward to the winter of 2025, and although the conflict continues, Verbruggen says currently there is no business disruption. “The Polish market stabilized in the new reality,” he says. “Some Ukrainian capital has also entered the Polish market to set up investments as a way to spread risk.”

Verbruggen notes there is much more trade now between Ukraine and Poland than at the beginning of the war. “However, as Ukraine is not part of the EU, that traffic is not very fluid, and there are still long waiting times in both directions at the border control points.”

While Verbruggen says sanctions against Russia have no impact on business or operations, they decided to close their branch office in Moscow. “Initially we put the development on hold, but then it was decided to close the office completely at the end of 2022.”

The conflict in Ukraine and sanctions against Russia have not directly impacted inventory levels and capacity. “Generally, companies have increased their buffer stocks over the last years,” Verbruggen says. “It was not only the war in Ukraine but also the pandemic, access to the Suez Canal and geopolitics in general.”

Regional Cold Chain

Poland, the second largest country in Central Europe, is one of the leading agrifood producers and one of Europe’s largest producers. Food exports play an important role in Poland’s multibillion-dollar economy.

The two major transport corridors connecting Poland to Northern Europe and Central Asia make it a regional food hub, extending beyond the European Union’s borders to the Mediterranean, North Africa and Asia. The country’s favorable location makes it fully accessible to the well-served road, air and rail links.

The cold chain logistics market in Poland is highly fragmented with a mixture of international and domestic players. As the demand for temperature-sensitive logistics solutions grows, particularly in the food and pharmaceutical sectors, the industry is poised for significant expansion.

With an annual investment of around $2 billion in new warehouses, storage capacity is set to increase significantly in the coming years. In addition, several factors are increasing the demand for transportation solutions in Poland, such as food, nuclear power plants, and temperature-sensitive machinery and equipment.

To meet the rising demand for cold chain logistics, companies are bolstering their warehousing and transportation capabilities. In September 2024, NewCold Logistics expanded and doubled its capacity at its automated warehouse in Kutno, Poland. “We are excited to further contribute to Poland’s status as a major European food logistics hub with this strategic expansion,” says Bram Hage, NewCold’s Founder and CEO. “The additional capacity at Kutno allows us to meet the growing demand from our customers in Poland.”

Just one example of the surging demand for cold storage across Poland.

Market Overview and Forecast

The cold chain logistics market in Poland is mainly driven by the surge in demand for fast moving consumer goods, a surge in trade activities and expanding warehouse and storage capabilities. As trading activities rise, so does the demand for cold chain logistics in the market.

In 2023, Poland achieved a record milestone, exporting agri-food products worth $54.83 billion, an 8.1% increase from the previous year, as reported by the Polish National Support Center for Agriculture.

In 2023, the European Union (EU) emerged as Poland’s primary trading partner, accounting for 73% of its agri-food exports, valued at $40.23 billion (7% year-on-year increase). Germany stood out as the largest recipient of Polish agri-food exports, importing goods valued at $14.08 billion (11% increase).

Other significant importers of Polish food include:

- The Netherlands ($3.39 billion/2% increase)

- France ($3.18 billion/4% increase)

- Italy ($2.81 billion/7% increase)

- Czech Republic ($2.54 billion/9% increase)

Beyond the EU, key recipients of Polish food products include:

- United Kingdom ($4.45 billion/14%increase)

- Ukraine ($1.09 billion/9% increase)

- United States ($920.96 million/13% increase)

Leading Polish exports to the EU are:

- Poultry meat ($3.28 billion)

- Dairy products ($2.33 billion)

- Bread and bakery items ($2.22 billion)

- Beef ($1.91 billion)

- Pet food ($1.80 billion)

In contrast, top exports to markets outside the EU include:

- Dairy products ($1.16 billion)

- Poultry meat ($1.01 billion)

- Bread and bakery items ($991.89 million)

- Chocolate and related products ($844.74 million)

Consumer Trends

A number of trends are shaping Polish consumption habits – all of which point towards a greater need for logistics options, according to the organizers of WorldFood Poland.

Frozen food consumption is on the rise. Forty-three percent of Poles, whose busy lifestyles leave little time for lengthy meal preparations, consume ready-to-eat, frozen meals on weeknights. This sector has been growing at roughly 3% annually. Expect suppliers to step up delivery orders in the coming years, which means increased scope for expansion into Poland for cold chain operators.

Where Poles buy food has also largely changed since the millennium. Hyper and supermarkets now dominate with a 72% market share of Poland’s food retail market, and are expected to grow.

Poland’s organic food sector is growing at an unprecedented rate, 20% year-on-year, meaning huge demand for fresh, top quality fruits and vegetables.

Verbruggen notes a recent change in consumer trends resulting from the war. “Because of the many Ukrainians in Poland, a lot of retailers now have a Ukrainian assortment of sweets and dairy products among other items.”

The cold chain logistics market size of Poland is estimated at $3.32 billion (USD) in 2025, and is forecast to reach $5.46 billion by 2030, at a compound annual growth rate (CAGR) of 10.43% during the forecast period 2025 to 2030, according to Modor Intelligence.*

Energy and Labor

The impact of rising inflation, fuel and energy costs on the region and the cold chain industry has stabilized, and most of the cost impact has been absorbed in pricing, notes Verbruggen. “I see no negative trend in the profitability of the cold chain sector. The general transport sector, unfortunately, does not share the same story line, and overall, it’s a difficult time for carriers and forwarding companies.”

In 2022, Verbruggen’s company had approximately 100 workers from Ukraine. He said a handful returned to Ukraine to join the military, which was temporarily disturbing without having a structural impact on operations.

“Many of the initial refugees, estimated at around 2 million, have regulated their stay and our integrating into society,” Verbruggen says. “This also meant a large inflow of new workers into the Polish economy, and in our sector, it means more warehouse workers and for retailers, many new cashiers.”

Demand for Polish Poultry*

Since the start of 2024, Poland has experienced a notable uptick in poultry meat production. Data from the Polish Statistical Office indicates that between January and May 2024, domestic poultry meat output surpassed 1.4 million tons, a 5.4% rise from the same timeframe in 2023. This surge in domestic poultry production can be largely attributed to falling feed prices, which bolstered production profitability.

Furthermore, robust export demand, heightened domestic consumption, and poultry’s competitive pricing relative to pork spurred producers to ramp up their output. Given the market dynamics and the enhanced profitability of poultry farming, a steady uptick in Polish poultry production was anticipated for the remainder of 2024.

Concurrently, export demand was invigorated by competitive pricing in the EU market and newfound opportunities in non-EU markets, especially after Poland’s avian influenza-free status was reinstated in April 2024.

This combination of factors exerted upward pressure on broiler chicken procurement prices. While there was an upward trend in prices, they remained below the levels of 2023. Nonetheless, thanks to reduced feed prices, the profitability of chicken production outpaced that of 2023.

*Source: https://www.mordorintelligence.com/industry-reports/poland-cold-chainlogistics

GCCA Cold Connection Poland

GCCA members met in Warsaw, Poland, in November 2024. The GCCA Cold Connection program is a great way to get an understanding of important and emerging cold chain markets and share experiences – to find out more about the meeting opportunities and other events across the world visit gcca.org/events.