A movement to rid the roads of carbon-based refrigerated transportation continues, even as some of the regulatory steam driving it has, at least for now, evaporated.

The U.S. state of California has led the world in driving decarbonization in refrigerated transportation. Most recently, its policies drew the ire of federal regulators and politicians who tapped the brakes on the state’s plan to quickly transition transportation refrigeration units (TRUs) operating in the state to Zero-Emission TRUs (ZE-TRUs).

Some, like Don Durm, Vice President of Supply Chain Solutions at PLM Trailer Leasing, argue that easing regulations could be good for the cold storage industry. The problem with the California regulation, Durm says, was that it was too optimistic about the pace of innovation. “If you really looked at what the manufacturers produce right now, even for the state of California, they probably couldn’t keep up with all the mandates. It lets innovation catch up and push forward.”

Meanwhile, industry observers say operators remain committed to a zero-emission future, with or without the leadership of California.

“Operators are driving decarbonization because the technology works and delivers results,” says Michael Lowe, CEO, Sunswap, a United Kingdom-based manufacturer of battery and solar-powered transport refrigeration units. “In markets like the UK and Europe, the industry is solving this challenge independently rather than waiting for regulation.”

Bill Maddox, Senior Manager, Product Management at Carrier Transicold, says the company’s customers are still interested in zero emission, but their motivations are different. Some see the value and the opportunity of zero emissions, because it’s part of their sustainability goals. Others are interested, Maddox says, because it can make them more profitable.

“I don’t think it’s going away, and I don’t think it’s a dying thing,” observes Durm. “I don’t think people are going to [say] we’re not doing this anymore.”

Regulation vs. Innovation

The decarbonization effort is ripe for industry-led innovation, says Lowe. “There are some potential signs that we could see a registration scheme [in the United Kingdom], as in how many TRUs we have in the fleet, for example. That’s not regulation. That’s literally understanding how many there are in the United Kingdom.”

Indeed, regulation continues to play an important role in decarbonization in some parts of the world. But innovation is driving the decarbonization effort forward in many markets, even in the absence of regulatory pressure and government support.

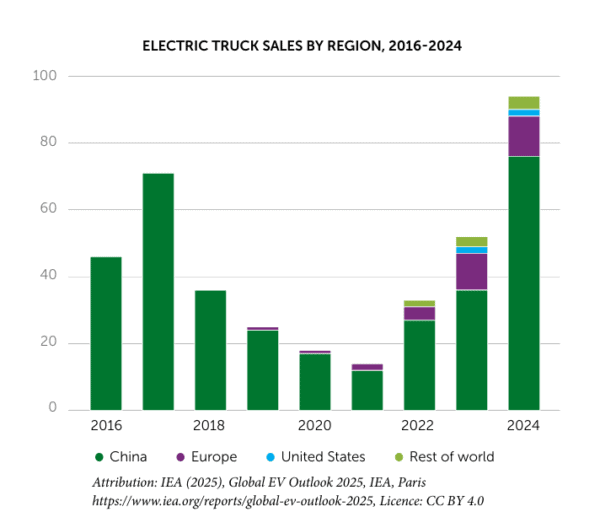

Electric Truck Sales

Global sales of medium- and heavy-duty electric trucks increased by nearly 80% in 2024, according to the International Energy Agency.

In China, which represents more than 80% of 2024 global electric truck sales, a combination of incentives, stringent emission standards and declining battery prices are driving sales.

Although ZEV adoption is slower in Europe and the United States, there are some signs of growth there too. In Europe, electric truck sales grew substantially in some countries, despite a lack of incentives, says the IEA. Sales grew in 2024 in Denmark, Germany, Italy, and the United Kingdom, but declined in France and the Netherlands.

In the United States, the number of electric trucks sold in 2024 exceeded the total number sold from 2015 to 2022. A tax credit of as much as $40,000, grants, and investments in charging infrastructure drove sales, says the IEA.

Cost of Entry

The cost of entry is high for zero-emission technologies. In battery electric vehicles (BEVs), the battery may represent as much as half the total cost of the truck today, but this is expected to change. By 2030, the IEA says the cost of these batteries may fall by as much as 35%.

“The reason FMCG retailers and fleet owners speak with Sunswap is sustainability – they want to replace their diesel fleets,” says Lowe. “But what’s compelling is that zero-emission technologies actually reduce operating costs. That combination of environmental impact and financial performance is crucial to meet sustainability goals and improve margins.”

While ZEV technologies have not yet reached total cost of ownership (TCO) parity with their ICE counterparts, the IEA anticipates that the TCO of battery electric trucks will be “more competitive than diesel trucks” in China and the European Union by 2030. The IEA also forecasts that TCO parity will soon follow in the United States, where emissions standards will effectively increase the cost of operating diesel trucks.

Meanwhile, the cost of a ZE-TRU alone can be as much as two-times the cost of a traditional diesel unit today, says Durm. He points to the leasing model as a sound strategy for ZE-TRUs or ZEVs, particularly while the industry is coalescing around specific technologies and while needed standards are in development. “They don’t have to make the initial investment, they just make a monthly payment,” adds Durm.

A Better Fit

All over the world, electrification is proving to be a better fit for certain use cases, suggesting that parity may be achieved sooner by some segments before it is achieved overall. Routes with some combination of lower daily mileage, lower speeds, and predictability are proving easier to electrify.

While owners of heavy-duty delivery trucks with high-mileage routes (which increases the potential for a cost benefit) are also exploring electrification in higher proportions, over-the-road heavy-duty trucks face distinct challenges. “They’re just constantly moving and doing different things. They’re never on a dedicated route or commodity,” observes Maddox.

These trucks could be hauling bananas at 55° F one week and premium ice cream at -20° F the next, Maddox says, or making runs from Florida to California, then California to Idaho. “Just keep moving, that’s how they’re efficient with their freight and that’s part of the challenge,” says Maddox. “Having that built-out infrastructure is fundamental because this technology could be anywhere – so if you can be agnostic on infrastructure, that is where you’ve got a key solution.”

“The other side is the world of Walmarts or Syscos, and they go from the distribution center to the stores. They are coming back to the same place, so they could have the opportunity to utilize charging at a base location,” says Maddox.

Lack of Charging Infrastructure

Today, electric fleet owners and operators often install depot chargers, allowing the fleet to charge overnight. The promise of electrification could extend to more segments with greater access to public or opportunity HDV charging stations.

Although charging stations with equipment dedicated to heavy-duty vehicles are lacking, especially compared to traditional fueling stations, progress is being made to improve charging infrastructure. The IEA, using a model that takes policy commitments into account, projects the global number of HDV truck charging points to increase from about 300 thousand in 2024 to more than 3 million by 2030.

In the United States, the lack of charging infrastructure presents a significant limitation for electric heavy-duty trucks. In January, the U.S. Department of Energy (DOE) announced a $68 million investment to design, develop, and demonstrate innovative electric vehicle (EV) charging sites near key ports, distribution hubs, and major corridors. The projects aim to accelerate access to largescale public EV charging infrastructure for medium- and heavy-duty EVs.

Each of the DOE-funded projects target large-scale, replicable, high-power charging installations to serve medium-and heavy-duty electric fleets with tens of hundreds of vehicles. They are focused on high-capacity charging infrastructure to serve medium-and heavy-duty electric trucks for long-haul use cases (more than 500 miles per day) along major corridors and rural regions where grid capacity is limited. The vision is for continued innovation to drive expansion of the charging infrastructure as technology costs decline and momentum grows for medium- and heavy-duty electrification.

Need for Cultural Change

The move to ZE-TRUs and ZEVs isn’t just about the equipment. Operators will play a large role in making the transition a smooth one.

Most TRUs are powered by internal combustion engines today, giving operators access to an enormous amount of energy stored in fuel tanks, says Maddox. “It covers a lot of sins,” he says, like leaving doors open while making a delivery or loading warm product and using the TRU to cool it enroute.

“You’ve always got enough fuel to get you where you need to go [with an internal combustion engine],” says Maddox. “When you go to a zero-emission solution, now we’ve got more finite power available. We just have to be smarter about how we use it.”

Media Contact

For media inquiries, please contact: Lindsay Shelton-Gross, Senior Vice President, Global Communications, Marketing and Strategic Initiatives, Global Cold Chain Alliance.