Demand for temperature-controlled logistics is growing in response to increasing trade opportunities and the continent’s shifting landscape.

Investment in cold chain growth in Africa is expanding, with great interest in developing temperature-controlled logistics facilities and services in existing cold chain networks. Investors are also focusing on establishing operations in new areas where cold chain services are nascent or non-existent.

The stakes couldn’t be higher. As Dr. Newton Matope, President of Kenya-based temperature-controlled logistics operator BigCold and Vice Chair of the GCCA Africa Advisory Council, notes, “Studies have shown that Africa loses up to 40% of perishable food due to inadequate cold storage and transport. Strengthening cold chain infrastructure will help reduce food waste, improve farmer incomes, and enhance food security across the continent.”

Drivers of Growth

According to international market analyst Research and Markets, the size of the African cold chain logistics market was estimated at $10.88 billion (USD) in 2024 and is expected to reach $14.85 billion by 2029, growing at a compound annual growth rate (CAGR) of 8.28%.

Temperature-controlled logistics experts leading the industry in Africa point to several factors driving this substantial market growth. Patrick Fernandes, CFO at Mozambiquebased Afrigotel, observes that awareness of food safety has grown significantly. He says this is partly due to an increase in products like yogurts, cheeses, and butters that require controlled temperatures for preservation.

Fernandes considers another key driver of cold chain growth to be producers’ concerns about waste and loss due to improper preservation of perishable products and the time it takes to reach the markets. “Consumers are more informed and demanding regarding the quality of products, especially those sold in supermarkets.”

Pharmaceutical and healthcare cold chain expansion is highlighted by both Dr. Matope and Fernandes as an important factor in Africa’s cold chain market growth, with the need for temperature-sensitive pharmaceutical logistics increasing, particularly for vaccines, insulin, and other critical medicines.

Dr. Matope also points to the rise of modern trade with supermarkets, hypermarkets, and fast-growing e-commerce grocery platforms (including dark stores and quick-commerce delivery) relying heavily on cold storage for inventory management. As these modern channels expand their footprint across African cities, the cold chain becomes a critical enabler.

Intra-Africa and Global Trade

Dr. Martin Cameron, Managing Director of Trade Research Advisory (a spin-off of the North West University in South Africa), explains that trade in products requiring the cold chain now represents around 5% (in value terms) of both total exports and imports for the African continent, with these levels fluctuating slightly between 2017 and 2023.

Dr. Cameron notes that intra-African trade in products requiring cold chain handling during this period accounts for only around 10% to 15% (in value terms) of the continent’s total exports and imports. “However, intra-Africa volumes represent around 30% of import volumes compared to less than 25% of exports to the rest of the world,” he adds. “The implication is that intra-Africa volumes traded are, on average, relatively lower value and higher volume than exports and imports for the continent associated with the rest of the world.”

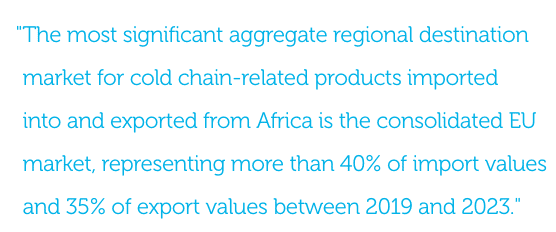

In terms of international trade, the top African markets for global exports of cold chain-related products are Morocco, South Africa, and Egypt. The most significant aggregate regional destination market for cold chain-related products imported into and exported from Africa is the consolidated EU market, representing more than 40% of import values and 35% of export values between 2019 and 2023.

Trade Research Advisory has calculated that, in value terms, imports and exports between Africa and the EU for cold chain related products remained relatively constant over 2024. In volume terms, African exports to the EU peaked in the first half of 2024, while African imports from the EU increased steadily in the second half of the year, partly due to the seasonality of the traded products.

The main products imported into Africa from the EU in 2024 included fresh or chilled seed potatoes, onions and shallots, frozen chicken cuts and offal, frozen swine offal, frozen whole chickens, and frozen swine meat. The main imports into the EU from Africa included tomatoes (fresh or chilled), chili peppers and bell peppers, sweet potatoes, beans (fresh or chilled), peel of citrus fruit or melons, bananas, clementines, avocados, and fresh grapes.

The North American market for cold chain-related products represents less than 5% of imports and slightly more than 5% of exports.

“In this context, the recent implementation of a blanket minimum 10% additional tariff on goods imported into the United States will negatively impact exports from Africa to the United States,” says Dr. Cameron. “However, the United States only represents approximately 3% of the export value of cold chain-related products originating from Africa. While this could be extremely negative for specific companies in specific countries dealing with less competitive pricing into the United States, on the whole, these types of products are not historically a significant market for the African continent.”

Demand and Capacity

The demand for temperature-controlled logistics in Africa is increasing in response to trade opportunities. Demand is also growing in response to the continent’s own changing needs.

The “Economic Report on Africa 2025,” a publication of the United Nations Economic Commission for Africa, states that by 2050, the proportion of Africa’s population living in urban areas will rise from 45% to 60%. This will contribute significantly to GDP but will also strain infrastructure and services.

Africa’s megacities, such as Cairo, Kinshasa, and Lagos, are expected to be among the 10 most populous cities globally by 2035. Meanwhile, emerging urban areas such as Accra, Addis Ababa, and Kigali are also experiencing rapid growth. “As Africa’s urban population grows and consumer preferences shift toward fresh and frozen products, the demand for cold chain services is rising,” says Dr. Matope.

A 2023 report by the Energy and Environment Partnership Trust Fund (EEP Africa) demonstrates the dramatic variability in cold chain capacity across different African nations. It reports that in South Africa, which has the most mature and sophisticated cold chain market in southern Africa, there is 13m3 of cold storage per 1,000 residents, with most cold chain solutions geared towards large commercial and self-owned farms or provided by third-party logistics providers.

EEP contrasts this with Rwanda, where in 2019, there was 6,162m3 of cold storage available in total, with 58% of this capacity used to cater to flowers for export. It also compares to Zambia’s cold chain, which it describes as “underdeveloped” and constrained by “poor road infrastructure, further exacerbated in the rainy season.”

For West Africa, a recent study by GCCA’s Global Cold Chain Foundation assessed cold chain logistics, technology, operations, and investment in Senegal, Ivory Coast, and Ghana as part of a USDA-funded Emerging Markets Program (EMP). This study showed that cold chain infrastructure in West Africa needs significant development, especially in ports and Special Economic Zones, to meet both current and future demand.

Key Opportunities and Challenges

With a clear need to increase cold chain capacity to meet growing demand throughout the continent, Africa’s temperature-controlled logistics leaders have identified several strong opportunities to accelerate cold chain market growth.

The expansion of regional trade through the African Continental Free Trade Area (AfCFTA) is one such opportunity. By 2045, AfCFTA is projected to increase intra-African trade by 45%, to enhance Africa’s GDP by 1.2%, and to boost the agri-food sector by 60%. Efficient cross-border refrigerated logistics will be crucial.

Dr. Matope also envisions growth opportunities as a result of evolving consumer preferences in Africa’s urban centers. “With rapid urbanization and a growing middle class, we’re seeing a clear shift toward protein-rich and perishable diets, including dairy, meats, fresh juices, and horticulture. This shift is putting pressure on supply chains to deliver safe, high-quality products, creating direct demand for cold storage and temperature-controlled transport solutions.”

For Fernandes, the cold chain in Africa can also expect to benefit from greater incentives for financing in refrigeration infrastructures by donor countries of pharmaceutical products and vaccines, and from the use of renewable natural resources, such as solar energy, to reduce energy costs.

Fernandes and Dr. Matope both note the potential for Public-Private Partnerships (PPP) to drive investments as governments and development agencies increasingly recognize the importance of cold chain infrastructure, offer incentives to attract investors, and develop new funding models and strategic partnerships to unlock growth opportunities.

However, they also both identify significant barriers to market growth, including high capital and maintenance costs; a deficient transport network; and a lack of reliable access to stable electricity. A bright spot is the emergence of solar-powered cold rooms, hybrid reefer trucks, and IoT-enabled temperature monitoring, making Africa’s cold chain more sustainable.

Both experts highlight that fragmented supply chains and logistics bottlenecks, such as poor infrastructure, inefficient transport networks, and cross-border trade barriers, slow down cold chain logistics. These issues are exacerbated by gaps in skills and workforce with shortages in cold storage management, refrigerated transportation, and compliance with safety standards.

In addition, Africa is disproportionately affected by climate change. According to the World Meteorological Organization, many African countries are already diverting up to 9% of their budgets responding to climate extremes. The cost of adaptation in sub-Saharan Africa is estimated to be between $30 and $50 billion annually over the next decade. The impacts of climate change and costs of adaptation may create an increasingly challenging environment for business growth.

GCCA Africa in 2025

The GCCA Africa Advisory Council’s strategic plan for 2025 focuses on addressing key challenges to market growth while supporting GCCA members in accessing and developing commercial opportunities. GCCA actions and activities to implement this strategic plan include strong promotion of the industry, positioning cold chain logistics as a key driver of economic and food security, and creating a stronger service provider market. It also includes regular engagement with governments, policymakers, investors, international organizations, and industry stakeholders.

Paul Matthew, GCCA Director for Africa, explains, “We are working with African governments to promote business-friendly policies, incentives, and regulatory reforms that encourage investment in cold chain infrastructure. We are fostering knowledge exchange and technical assistance with relevant organizations worldwide, and we are creating opportunities for cold chain businesses to gather to discuss shared challenges and collaborate on potential new opportunities.”

The GCCA Africa Cold Chain Conference 2025 will take place in Durban, South Africa, on 20-21 August. Visit the event page to register and for more information on the conference program.

Media Contact

For media inquiries, please contact: Lindsay Shelton-Gross, Senior Vice President, Global Communications, Marketing and Strategic Initiatives, Global Cold Chain Alliance.