COLD FACTS Magazine

The bimonthly COLD FACTS magazine is a direct link to 5,000 of the top decision-makers in the international cold chain. Published by the Global Cold Chain Alliance (GCCA), COLD FACTS is the definitive resource for the Core Partners of the Global Cold Chain Alliance, delivering detailed articles on the latest cold chain trends and advances.

Members of GCCA partner organizations can access COLD FACTS archived articles online.

Select an issue below to view its contents.

Featured Article

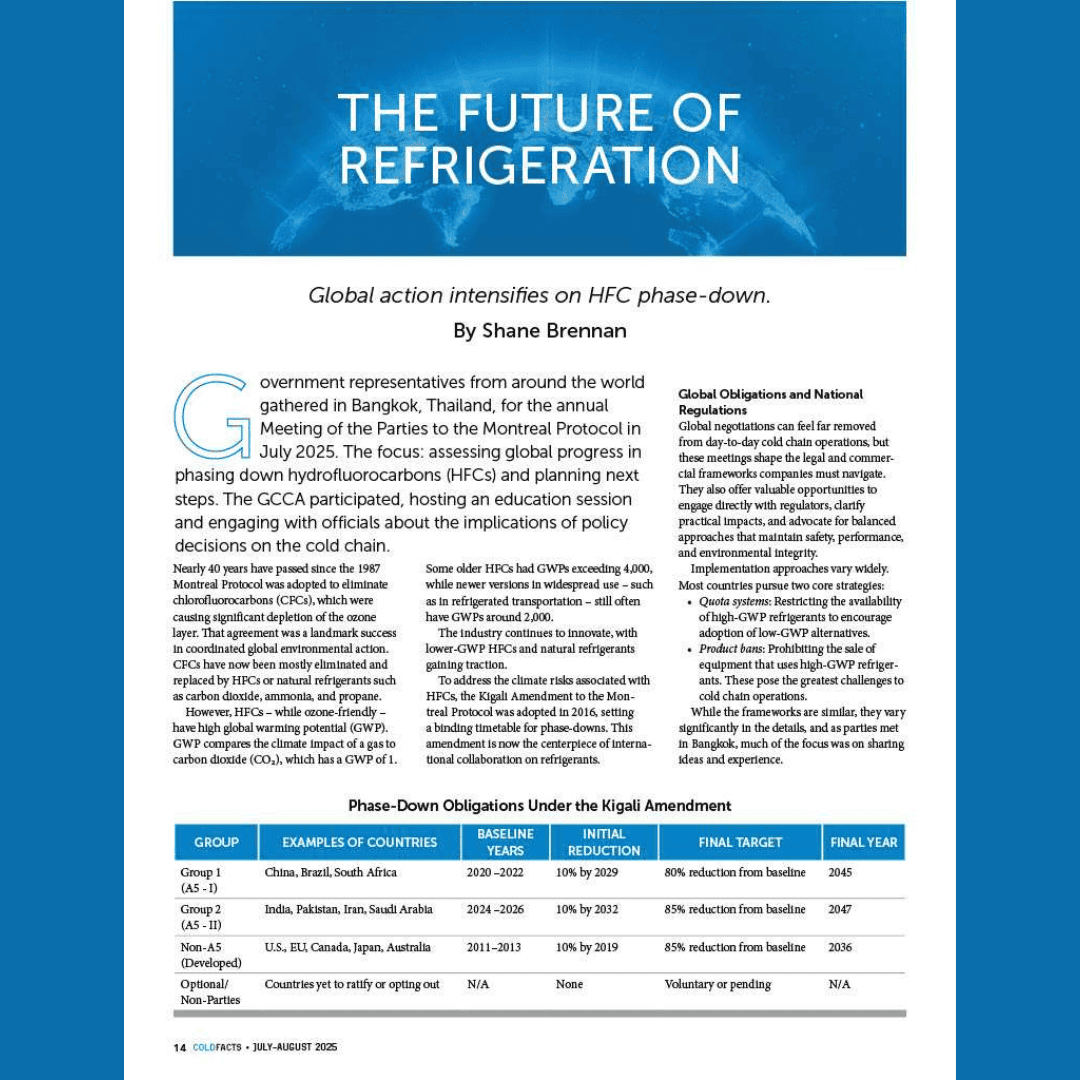

COLD FACTS: July – August 2025

The July-August 2025 issue of Cold Facts Magazine delivers a crucial analysis of the key forces shaping the…

COLD FACTS: May – June 2025

Explore the critical issues shaping the global cold chain in the May - June 2025 issue of COLD…

COLD FACTS: March – April 2025

From COLD FACTS Magazine (Click Image) Features Trump Moves to Transform the U.S. Federal Government A regulatory freeze,…